Small Business Spotlight

Small business refinance & expansion with a fleet of liens

The complexities of a plumbing company’s deal almost prevented a major milestone.

Loan Amount #1

$1,440,000

Loan Amount #2

$316,100

Loan Purpose

The Small Business

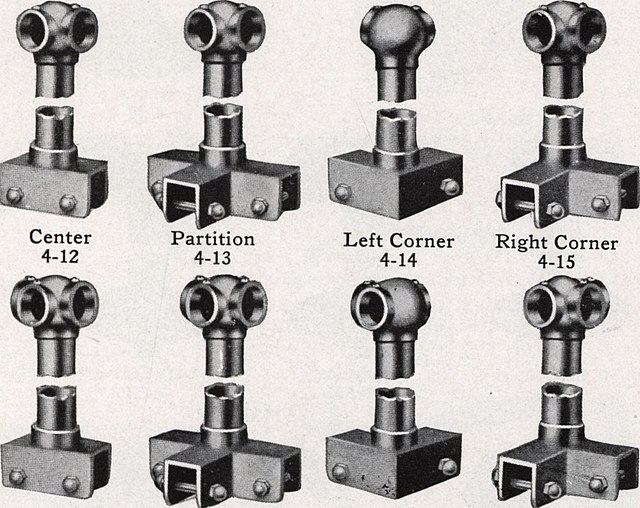

A Plumbing Company

Long Island City, New York City

The Financing Challenge

The owner of a plumbing company in Long Island City was ready for a major career milestone: purchasing his competition’s business. The goal was a small business loan for acquisition and an equipment refinance. But getting there was anything but simple.

Loan Scenario

Here's what our borrowers brought to Ready Capital

Risk

The deal was unsecured.

Moving parts

A fleet of 30 vehicles in need of appraisal for liens.

Category challenge

A deal that was difficult to move forward as a business acquisition.

CREATIVE SOLUTION

Ready Capital met the complexity of the deal with constant follow-up. They decided to treat the borrower’s case as an expansion as opposed to an acquisition, making a successful deal possible.

Reliable Results

- Locked in two separate SBA 7(a) loans for the borrower: $1,440,000 and $316,100.

- Covered a refinance of the borrower’s current property and vehicles.

- Delivered the deal done with 100% financing (no money down).

The Non-Bank SBA Preferred Lending Partner Difference

A small business loan is not an empty box like a checking or savings account. No two small businesses are alike when it comes to their financing needs. This means that small business financing requires out-of-the- box thinking and capabilities many banks simply don’t offer.

Ready Capital is a non-bank, SBA preferred lending partner (PLP). We speak fluent small business and have the process in place to help them reach their goals the first time.