Loan Programs > Commercial Real Estate > Freddie Mac SBL

Freddie Mac Small balance loans (SBL)

Get the attention and follow-through you deserve for your multifamily deals from a 2024 Top 5 Freddie Mac SBL lender.

Overview

With 10 years of small balance multifamily lending, Ready Capital provides a one-stop solution for $1 million to $7.5 million small balance loans (or larger portfolios comprised of small balance loans).

Your one-stop solution for small balance multifamily financing

-

A 2024 Top 5 Freddie Mac SBL lender and a nationwide Freddie Mac SBL Optigo® lender.

- Complementary small balance multifamily Bridge program, featuring no exit fee when refinanced under Ready Capital’s SBL program.

- Dedicated staff with a keen focus on small balance multifamily.

- Fast and reliable review of loan opportunities by experienced front-end “speed underwriting” team (same-day LOI execution in some instances).

- Loans consistently closed per the original terms and by a proven back-end underwriting team that has deep program knowledge and relationships.

- Simplicity, transparency, and reliability with industry-leading sizing and pricing tools.

Freddie Mac SBL for Multifamily Properties

With a customer-centric approach focused on speed, ease, transparency, and reliability, Ready Capital has been a leading Freddie Mac SBL Optigo® lender for over a decade and is a 2024 Top 5 Freddie Mac SBL lender. For small balance multifamily financing solutions from $1 million to $7.5 million (larger for portfolios) nationwide, Ready Capital is an agency lender you can count on.

Loan Terms

| Loan Purpose | Acquisition, refinance, recapitalization |

| Loan Amount |

$1 million to $7.5 million (larger for portfolios) |

| Loan Term |

5, 7, 10 Fixed, or 5, 7, 10 Hybrids at loan term of 10, 10, 20 |

| Rate Type |

Fixed or Fixed-to-Floating (Hybrid) Rate is locked at LOI execution |

| Closing Timeline | 45 to 60 business days |

| Fees | None (par to lender) |

| In-Place DSCR |

1.20x Top Market 1.25x Standard Market 1.30x Small Market 1.40x Very Small Market |

| Amortization | 30 years; partial and full-term interest only available |

| Leverage |

80% Top Market; 80% Standard Market; 75%* Small Market; 75%* Very Small Market *70%, if refinance |

| Escrows | RE Taxes if LTV > 65%; Reserves if >50 units |

| Non-Recourse | Non-recourse with standard carve-outs |

| Prepayment | Multiple stepdown and prepayment options available |

| Legal Fees | Generally $7,500 or less per loan |

Borrower peace of mind

If borrowers are concerned about interest rate volatility and hefty deposits and costs to early rate-lock, Freddie Mac SBL may be the right financing solution. For no additional cost on the first day of the process (at time of executed LOI), the Freddie Mac SBL rate is automatically locked and held until the closing date.

SMALL BALANCE MULTIFAMILY FINANCING - CASE STUDIES

Your one-stop shop for small balance multifamily Bridge and Freddie Mac SBL

Small balance Bridge acquisition loan & Freddie Mac SBL refinance loan

19-unit apartment complex

Hollywood, FL

- $1.8MM / 71% LTC Bridge acquisition loan

- Renovation of a coastal 1960s vintage complex

- $2.264MM cash-out Freddie Mac refinance loan 1.9 years later upon business plan execution

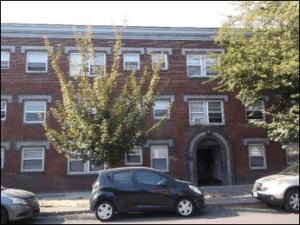

Small balance Bridge acquisition loan & Freddie Mac SBL refinance loan

25-unit apartment building

Portland, OR

- $2.6MM / 66% LTC bridge acquisition loan

- Light reposition of well-located, under-managed asset

- 35-day quick close Bridge loan to take advantage of opportunistic acquisition

- $2.68MM cash-out Freddie Mac SBL refinance loan upon minimal seasoning

Small balance Bridge acquisition loan & Freddie Mac SBL refinance loan

58-unit apartment complex

Albuquerque, NM

- $4.05MM / 75% LTC Bridge acquisition loan

- Significant reposition of well-located, mid-century complex

- $4.31MM cash-out Freddie Mac SBL refinance loan 1.3 years later, upon business plan execution

Nationwide lending at its best

Our professionals have deep industry expertise, offering investors and sponsors commercial real estate know-how and confidence through all markets and credit cycles.